In financial circles worldwide, a debate is intensifying over stablecoin payments and their impact on traditional banking and payment networks. Stablecoins – digital tokens pegged to fiat currencies like the U.S. dollar – have rapidly evolved from a niche cryptocurrency concept to a global payments phenomenon. Their promise of near-instant, low-cost transactions across borders, around the clock, is challenging decades-old payment infrastructures. This has left banks and card networks weighing a critical strategic question: Are stablecoins a disruptive threat to their business models, or can they be a much-needed lifeline that propels them into the next generation of finance?

This article takes an analytical look at how major financial institutions, card companies, and fintech players across North America, Europe, Asia, and emerging markets are approaching stablecoins. Rather than sounding alarm bells, many incumbents are tentatively embracing the opportunities stablecoins offer – from cheaper cross-border transfers and improved financial inclusion to entirely new business models. Backed by recent pilots, regulatory moves, and innovation initiatives from the likes of PayPal, JPMorgan, Circle, Visa, and even central banks, we’ll examine why stablecoins might be more of a boon than a bane for legacy finance. The competitive implications are profound: those who adapt could find stablecoins strengthening their franchises, while those who resist may see others leapfrog ahead in the race to modernize payments.

The Rise of Stablecoins in Global Payments

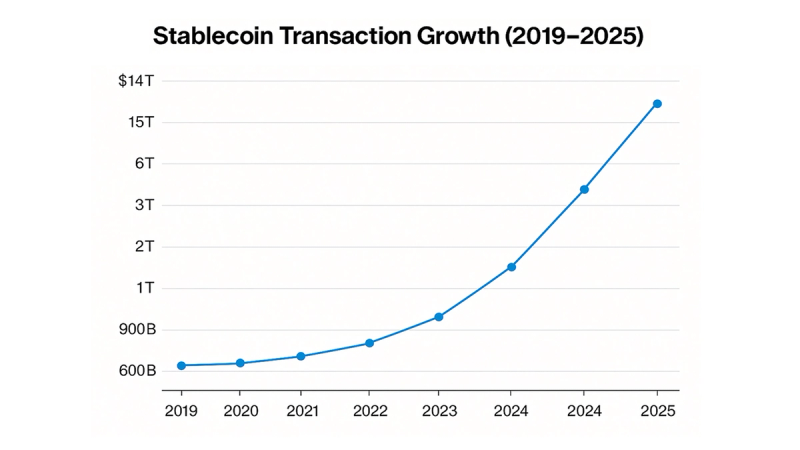

Stablecoins have gained a remarkable foothold in the global financial ecosystem over the past few years. These digital tokens are typically backed one-for-one by assets like bank deposits and U.S. Treasury bills, allowing them to maintain a stable value against a target currency (most often the U.S. dollar). This stability makes them practical as a medium of exchange, unlike volatile cryptocurrencies such as Bitcoin. The numbers tell the story of their rapid ascent: the total outstanding value of stablecoins has roughly doubled in the last 18 months alone, approaching $250 billion in circulation by mid-2025. Daily transaction volume in stablecoins now averages around $20–30 billion, which, while still under 1% of global payments flows, represents a sharp increase from just a few years prior. In fact, industry analyses indicate stablecoin transaction volumes have grown by an order of magnitude in about four years, exceeding an annualized $27 trillion in on-chain payments. If that trajectory continues, stablecoin volumes could reach hundreds of billions of dollars per day within the next few years, a scale that would firmly entrench them in mainstream finance.

Several factors are powering this rise. First, stablecoins address long-standing pain points in payments by leveraging blockchain technology. They enable 24/7 real-time settlement (no waiting for batch processing or banking hours) and can significantly lower transaction costs by bypassing many intermediaries. A cross-border transfer that might take days and hefty fees via correspondent banks can potentially be completed in seconds on a blockchain for pennies. Second, stablecoins bring greater transparency and traceability to transactions – every movement is recorded on a public ledger – which can improve compliance checks (through automated on-chain analytics for anti-money-laundering and sanctions screening) and reduce fraud. Third, stablecoins have benefitted from a series of tailwinds: improving regulatory clarity, more scalable blockchain networks, and growing institutional involvement. While early skepticism from traditional institutions is fading, numerous pilots and use cases are demonstrating that stablecoins can complement – not just threaten – the existing system.

Crucially, stablecoins are no longer just a tool for crypto traders. They have emerged as a global alternative payment rail. Today stablecoins are being used to facilitate everything from remittances for migrant workers, to cross-border business transactions, to acting as a safe dollar savings option in inflation-prone economies. This broadening utility has caught the attention of banks and payment companies. Rather than dismiss stablecoins as a passing fad, many incumbents now acknowledge that these digital dollars (and digital euros, etc.) could play a significant role in the future of money movement. The conversation has shifted from “Will stablecoins disrupt us?” to “How can we position ourselves in this stablecoin-driven future?”.

Cross-Border Transactions and Financial Inclusion

One area where stablecoins show outsized potential is cross-border payments – a domain long due for disruption. International payments today are often slow, expensive, and opaque. Sending money from, say, the United States to an emerging market in Africa or Southeast Asia can involve a chain of intermediary banks, each taking a fee, with final delivery taking days. For businesses, this ties up working capital; for individuals (like migrant workers sending remittances), high fees cut into hard-earned income. According to World Bank data, the average cost of sending a $200 remittance in 2024 was about 6.6% (over $13 in fees) – more than double the United Nations’ target of 3%. Stablecoins offer a compelling alternative: a transfer of a dollar-pegged stablecoin from a payer’s digital wallet directly to a recipient abroad can settle in minutes (or less) at a cost often under 1%. Essentially, stablecoins allow money to move at internet speed.

This advantage is driving a flurry of experiments aimed at reducing friction in cross-border payments. Fintech firms and even traditional money transfer operators are exploring stablecoin-based corridors. For example, Western Union – one of the world’s largest remittance providers – announced in 2025 that it is piloting stablecoin settlements for transfers in regions like South America and Africa. In this closed-loop test, Western Union isn’t viewing crypto rails as a competitor but as a way to improve its own foreign exchange and settlement process in hard-to-reach markets. By using stablecoins behind the scenes, Western Union aims to cut the time and cost of moving funds between its agents and local payment partners. The company’s CEO noted that stablecoins could help streamline currency conversion and liquidity in corridors where traditional banking is less developed, and even allow customers the option to receive funds in digital dollars rather than local currency if they prefer.

Likewise, PayPal – a digital payments pioneer – has zeroed in on cross-border use cases for its USD stablecoin launched in 2023. PayPal’s CEO Alex Chriss emphasized in a June 2025 interview that stablecoins hold unique value for international transactions, especially in underserved regions where access to modern banking is limited. In the U.S. and other advanced economies, consumers have little trouble sending money digitally (via bank apps, cards, etc.), so stablecoin adoption for everyday domestic payments remains slow. But in countries with less banking infrastructure or volatile local currencies, stablecoins can be a lifeline. They enable people to participate in global e-commerce and finance with just a smartphone, effectively bringing financial inclusion to populations that have been left on the margins of the traditional system. Stablecoins also allow small businesses in emerging markets to engage in cross-border trade without needing expensive intermediaries or worry about currency devaluation overnight.

Real-world trials back up PayPal’s strategic focus. In late 2024, PayPal made headlines for using its PayPal USD (PYUSD) stablecoin to settle international remittances for two of its Xoom money transfer partners – one in the Philippines and one in Africa. Instead of going through the usual chain of bank withdrawals and deposits, the remittance transactions were settled by moving PYUSD tokens on a blockchain, which the receiving partners could then convert to local currency for payout. The result was faster settlement and lower cost. PayPal additionally has experimented with using PYUSD for its own corporate cross-border payments. The company disclosed that it successfully paid an international consulting firm (Ernst & Young) and a cloud services provider (Google) using stablecoins, showing how even large B2B cross-border invoices might be handled more efficiently outside of bank wires. All these efforts point to the same conclusion: stablecoins dramatically reduce the “friction” in cross-border money movement.

Beyond efficiency, stablecoins carry a broader social impact in these contexts. They effectively turn the smartphone into a bank branch for millions of unbanked people. For someone in a country with high inflation and limited banking access – say, Venezuela or parts of Africa – receiving a remittance in a U.S. dollar stablecoin can be far more valuable than getting the equivalent in local currency. It provides a stable store of value and a means to transact or save without a traditional bank account. We’re already seeing grassroots adoption of dollar-pegged stablecoins in places like Argentina, Nigeria, and Turkey, where individuals use them as a hedge against currency instability. Financial institutions are noting this organic usage and beginning to build services around it. For example, MoneyGram (a remittance company) now enables people in 180+ countries to convert cash to USDC stablecoins and vice versa through its outlets, effectively bridging physical cash networks with crypto networks. This kind of integration hints at a future where sending money abroad might commonly involve stablecoins as the transmission medium, even if end-users aren’t aware of the technology under the hood.

All told, cross-border payments appear to be the beachhead use case for stablecoins in payments. The incentive to cut costs and time is strongest there, and the beneficiaries – from global businesses to migrant families – stand to gain significantly. Banks and card networks, seeing this trend, are increasingly determined to ensure that if stablecoin remittances take off, they will be participants in that new ecosystem rather than bystanders.

Card Networks Embrace Innovation, Downplay the Threat

The major card networks, Visa and Mastercard, occupy a central position in global payments – and they intend to keep it that way in the stablecoin era. At first glance, one might think these companies would perceive stablecoins as a threat: after all, if consumers and businesses could send money directly to each other via blockchain, why use card rails or pay card interchange fees? However, Visa and Mastercard are taking a more nuanced, proactive approach. They are openly embracing elements of stablecoin technology and exploring ways to incorporate stablecoins into their services, all while confidently dismissing the notion that stablecoins will disintermediate them anytime soon.

Recent statements and initiatives from both networks underscore this dual strategy. Visa, for instance, has been “angling to get in on stablecoins” by developing capabilities for stablecoin settlement. In 2021, Visa became one of the first large payment networks to test settling transactions in a stablecoin (USDC) on the Ethereum blockchain, in a pilot with the crypto platform Crypto.com. That pilot proved that a card issuer could send Visa the funds it owes (for its users’ transactions) in near-real-time using a stablecoin instead of waiting days for a wire transfer. By 2023, Visa expanded this program: it announced partnerships with merchant acquirers Worldpay and Nuvei to start receiving (and now even sending) settlement payments in USDC, and it added support for the Solana blockchain to complement Ethereum for these operations. In practice, this means when a consumer uses a Visa card at a store in another country, the behind-the-scenes settlement between the consumer’s bank and the merchant’s bank could be executed via stablecoins, greatly speeding up reconciliation. Visa’s Head of Crypto, Cuy Sheffield, said the goal is to improve the speed of cross-border settlement and offer clients a “modern option” to move funds, leveraging the 24/7 availability of public blockchain networks. Far from seeing crypto networks as competition, Visa is positioning itself as the bridge between traditional currencies and blockchain-based currencies – much as it already connects 150+ fiat currencies in its global network.

Mastercard is equally active. The company’s leadership has repeatedly affirmed that while they don’t view stablecoins as an existential threat at present, they are investing in stablecoin integration for the opportunities it brings. In 2023 and 2024, Mastercard announced partnerships with crypto firms (for example, working with Paxos to help banks and merchants more easily accept stablecoin payments, and with fintech companies like Uphold and Immersve to launch crypto-funded Mastercard cards). In April 2024, Mastercard partnered with payment tech company Nuvei and crypto exchange OKX to enable users to spend stablecoins directly from their digital wallets wherever Mastercard is accepted. These moves essentially allow stablecoin holders to use their tokens for everyday purchases, with Mastercard doing the currency conversion on the backend and routing the payment through its network. Mastercard’s Chief Product Officer, Jorn Lambert, noted that stablecoin payments today are very nascent – he cited that roughly 90% of stablecoin usage is still for crypto trading rather than commerce – but he acknowledges the technology’s promise of “high speed, 24/7 availability, and low cost.” The company is preparing for a future where those attributes become important in mainstream payments. Mastercard’s CFO, Sachin Mehra, speaking at an investor conference in 2025, even highlighted that the firm is playing an active role in exploring stablecoin use, particularly for B2B payments, and will continue to do so “organically and inorganically” (hinting that acquisitions of crypto-related capabilities are possible).

Why are Visa and Mastercard confident that stablecoins won’t upend their dominance overnight? Partly because of the entrenched strengths of card networks that stablecoins alone can’t match yet. These companies point out that billions of consumers and millions of merchants are deeply habituated to using cards and trust the protections that come with them (fraud dispute resolution, chargebacks, etc.). Stablecoin transactions on a blockchain are irreversible and bearer-based – more akin to digital cash – which can be a downside for consumer payments where refunds and fraud mitigation are important. There’s also the issue of acceptance: there is not yet a universal, convenient standard for merchants to accept a variety of stablecoins directly in point-of-sale systems. By contrast, Visa and Mastercard acceptance is virtually ubiquitous. These factors mean that for business-to-consumer (B2C) commerce, stablecoins alone have a high hurdle to clear before they could replace card payments. In fact, internal analysis from one investment firm in 2025 concluded that stablecoins, despite their growth, are “not well suited for consumer commerce” in the near term, precisely because of consumer behavior and lack of payments infrastructure around them. This gives the card networks some breathing room.

Additionally, Visa and Mastercard are turning stablecoins into an opportunity by offering value-added services around them. Both networks have started crypto advisory services to guide financial institutions and merchants interested in digital currencies. They are also building out interoperability solutions – for example, Mastercard has talked about its role in enabling interoperability among multiple stablecoin systems, leveraging its experience in connecting disparate payment systems globally. If dozens of private companies end up issuing different stablecoins (USD Coin, Tether, a JPMorgan coin, a PayPal coin, etc.), there will be a need for a network to make them work seamlessly together and with fiat money. The card networks are natural contenders to fill that role, turning a potential threat into a new business line.

It’s worth noting that investors have kept a cautious eye on how the card giants handle the crypto trend. In mid-2025, as U.S. Congress advanced landmark stablecoin legislation (more on that later), Visa and Mastercard saw brief dips in their stock prices due to fears that a legal framework for stablecoins might pave the way for more competition in payments. But both companies’ responses – highlighting their own defenses and strategies – have largely reassured the market. Analysts point out that the card networks’ moves to “build their own stablecoin infrastructures” and embed themselves in the stablecoin ecosystem are savvy hedges against disruption. Moreover, any shift toward stablecoin usage in payments is likely to be gradual and occur first in specific niches like cross-border transfers or business transactions, giving networks time to adapt. A Mizuho Securities analyst remarked that while stablecoins have the potential to reduce settlement times and fees (a clear long-term disruptive force), worries about Visa and Mastercard losing their core consumer payments business are “overblown” in the short run. In his view, these incumbents are primarily exposed to areas like consumer credit cards, which remain sticky and offer benefits (like credit access and rewards) that a basic blockchain transaction does not.

In summary, card networks are treating stablecoins not as adversaries but as a new form of currency to be integrated. Their strategy is to remain indispensable by handling the “on-ramps and off-ramps” – enabling users to move easily between stablecoins and traditional money, and enabling merchants to accept payments without worrying about the underlying currency. By doing so, Visa and Mastercard aim to ensure that even if the form of money changes (from physical or bank-issued dollars to tokenized dollars), the networks facilitating commerce continue to thrive.

Banks Weigh the Risks and Rewards

Banks, especially large global banks, have been more cautious in their public approach to cryptocurrencies, but stablecoins are increasingly capturing their attention as well. For banks, stablecoins pose a more complex equation: they touch on core banking functions like deposits, payments, and foreign exchange. On one hand, if customers start preferring to hold and transfer money in the form of private digital tokens, banks risk disintermediation (less deposit funding and fewer payment flows through the banking system). On the other hand, stablecoins and the underlying blockchain tech could be harnessed by banks to upgrade their own systems, making them faster and more competitive. In 2025, the tone among banking leaders has shifted from skepticism to guarded engagement. Many banks are concluding that they must get involved in stablecoins in some fashion – to “be at the table” as this innovation unfolds – rather than risk being left out.

A notable example is JPMorgan Chase, the largest bank in the U.S., which has been a pioneer among banks in exploring blockchain for payments. JPMorgan early on developed its own permissioned blockchain and a token called JPM Coin, effectively a stablecoin backed by deposits, used for instant value transfer inside the bank’s operations. That system, now branded as part of the bank’s “Onyx” division, enables 24/7 real-time cross-border payments between JPMorgan’s institutional clients. As of late 2023, JPM Coin was reportedly moving over $1 billion in transactions daily for clients – evidence that a bank-issued stablecoin could indeed find commercial traction. By 2025, JPMorgan stated that this network (now also called Kinexys Digital Payments) processes even more – around $2 billion per day – facilitating things like intra-company transfers for corporate treasury or liquidity flows between JPMorgan’s branches in different countries. Essentially, JPMorgan built a private stablecoin to give its clients the benefit of instant settlement, especially for international payments, while keeping the activity within a bank-regulated environment.

Now JPMorgan is taking things a step further. In June 2025, the bank announced plans to pilot a deposit token on a public blockchain – provisionally called JPMorgan Digital Coin (JPMDC). Unlike the original JPM Coin (which runs on a private, permissioned ledger accessible only to the bank and its direct partners), this new deposit token would be issued on a public blockchain network and could potentially be used by other banks or corporate entities that are not JPMorgan clients, broadening its utility. The rationale is to stay ahead of the curve: if significant transactions start moving on public chains, JPMorgan wants to have a native bank token that can interoperate out in that open ecosystem, not just on its private network. Notably, JPMorgan’s CEO Jamie Dimon has famously been a cryptocurrency skeptic in the past, but even he concedes that tokenized money movement is a real trend. On a 2025 earnings call, Dimon indicated that while he doesn’t fully see why a privately issued stablecoin is needed “as opposed to just using bank payment systems”, he nonetheless doesn’t want JPMorgan to fall behind: “They’re [fintechs] trying to figure out a way to create bank accounts and get into payments... We have to be cognizant of that. The way to be cognizant is to be involved. So we’re going to be in it... and be a player.” In practice, this means JPMorgan will continue investing in both its own deposit-token initiatives and stablecoin research, ensuring it understands the tech deeply and can serve clients who want to use it.

Other major banks are charting similar courses. Citi (Citigroup) has been exploring digital asset use cases and went live in 2022 with “Citi Token Services,” a platform for tokenizing customer deposits to facilitate instant payments for institutional clients. By 2025, Citi reported that this service is operational in four countries and has handled billions in transaction volume. When asked about stablecoins specifically, Citi’s CEO Jane Fraser outlined four areas the bank is focusing on: (1) reserve management for stablecoins (which implies Citi sees a role in holding or managing the asset reserves that back third-party stablecoins – a new custodial business opportunity), (2) providing on/off-ramps between cash and coins (so clients can seamlessly convert fiat to stablecoin and vice versa), (3) potentially issuing a Citi-branded stablecoin down the line, and (4) expanding the tokenized deposit platform for always-on corporate payments. She also mentioned offering crypto custody as part of their service suite. Fraser characterized this whole space – stablecoins and deposit tokens – as “a good opportunity for us.” This is a notable shift in tone; banks traditionally have been wary of anything that isn’t government-issued money, but here a top CEO is essentially saying: we see business to be done in stablecoins.

Beyond JPMorgan and Citi, numerous banks across regions are either testing or implementing stablecoin-like solutions. In Asia, for example, Standard Chartered, HSBC, and DBS joined forces with Singapore’s central bank (MAS) on Project Guardian, which successfully tested using tokenized deposits (a variant of stablecoins) for cross-border trades and settlements in a regulated environment. In Europe, several banks are part of the Canton Network, a consortium exploring tokenized assets and interbank digital cash. Even mid-sized U.S. banks have dabbled: an idea was floated about a consortium of banks creating a shared stablecoin for interbank payments (akin to how Zelle is a bank-owned network for P2P payments). While that hasn’t materialized publicly yet, the fact that analysts are asking CEOs about it shows the concept is on the table.

It’s not all enthusiasm, however. Banks remain mindful of risks and unanswered questions around stablecoins. One big concern is regulatory and legal status: historically, there was uncertainty about whether a stablecoin might be deemed a security or whether banks could legally tokenize deposits. This is starting to be resolved with new laws (discussed in the next section), but banks tread carefully until rules are crystal clear. Another issue is the impact on the traditional deposit model. If a customer holds $10,000 in a bank account, that provides funding the bank can use for lending. If instead the customer converts that to $10,000 in a private stablecoin (backed by, say, short-term government bonds), the bank loses that deposit funding. If stablecoins were to gain major adoption, banks fear a world where a chunk of money might sit in non-bank stablecoins (like USDC or tether) rather than in savings or checking accounts, which could pressure bank liquidity and loan-deposit ratios. Central bankers and regulators have echoed this concern: widespread stablecoin use could theoretically reduce deposits in the banking system, so banks need strategies to respond.

One such strategy is for banks to issue their own stablecoins or deposit tokens, capturing that activity internally. This way, if customers want digital dollar tokens for fast payments, the bank can offer one that is 100% backed by deposits at that same bank – keeping the funds in-house. This is effectively what JPMorgan and Citi are working on. Another strategy is to provide services around third-party stablecoins: for instance, a bank might become a custodian of reserves for a stablecoin issuer (earning fees and maintaining a connection to the flow of funds), or integrate stablecoins into its banking apps for customers (so customers can hold or send stablecoins through their familiar bank interface, rather than going to an outside crypto wallet). Some banks are already acting as settlement agents for stablecoin issuers or exploring white-labeled stablecoins (imagine a big bank issuing “BankCo Coin” which is just as trusted as its regular deposits).

In short, banks are increasingly engaging with stablecoins on multiple fronts – internal innovation, partnerships, and lobbying for clear rules – even if a few top executives voice lingering skepticism. They see both offense and defense at play: offense, in that stablecoins could open new lines of business (faster cross-border payments, digital asset custody, etc.) and generate fee income or interest revenue from float; defense, in that failing to accommodate client interest in crypto and digital dollars could mean losing relevance to fintech competitors. As one banking executive put it, ignoring stablecoins would be like ignoring the rise of the internet – a risk no large bank is willing to take.

Fintech Firms and Payment Platforms Lead the Charge

While banks and card networks proceed prudently, fintech companies and newer payment platforms have been far more aggressive in implementing stablecoin solutions. Unencumbered by legacy systems and often more willing to experiment, these players have effectively become the innovation lab for stablecoin payments, blazing a trail that larger institutions are now following.

One of the most closely watched examples is PayPal’s stablecoin initiative. PayPal made waves in August 2023 by launching PayPal USD (PYUSD), the first stablecoin issued by a major global payment company. This move signaled that PayPal views blockchain-based digital money as a natural extension of its business. Since then, PayPal has been steadily integrating PYUSD into its products. Users in the US can buy, sell, and hold the stablecoin in their PayPal wallets, and the company is working on enabling customer payments with PYUSD wherever PayPal is accepted. The deeper strategy, as mentioned earlier, centers on cross-border transactions. PayPal is leveraging PYUSD for international payouts – for example, allowing payouts from U.S. businesses to overseas contractors or sellers, with those recipients able to receive digital dollars that they might later convert to their local currency or keep as dollars. In 2024, PayPal even announced plans to make PYUSD available on multiple blockchain networks (including faster ones like Solana in addition to Ethereum) to ensure the stablecoin transactions are as efficient as possible. By investing in multi-chain operability and compliance, PayPal is effectively constructing its own stablecoin payment infrastructure parallel to card and bank networks. This could reduce its reliance on traditional rails over time and cut costs (every time a user adds funds to PayPal or PayPal routes money internally, using PYUSD on a blockchain could be cheaper than paying bank fees).

Payoneer, a fintech known for facilitating cross-border payments for freelancers and small businesses, is another adopter. The company caters to many users in emerging markets who do contract work or e-commerce and need to receive payments from the U.S. or Europe. In 2025, Payoneer began testing stablecoin integration to help these customers get paid faster and on weekends. Its CEO has spoken about the excitement around stablecoins in “cross-border trade” and hinted that Payoneer will soon offer options to receive payouts in stablecoin form. Given Payoneer’s large customer base in places like Latin America, the Middle East, and Asia, this could significantly boost stablecoin usage for business transactions and supplier payments.

Then there are the traditional money transfer giants pivoting toward crypto. MoneyGram, as noted, turned crypto-friendly by enabling USDC stablecoin transfers that can be cashed out in local currency through its agent network. This essentially blends the old and new – a customer can convert dollars to USDC, send the USDC across the world in seconds, and the recipient can pick up cash minutes later. MoneyGram reported strong uptake in certain corridors (for instance, sending from the U.S. to the Philippines or Kenya via USDC) because it’s cheaper and almost instant compared to SWIFT wires or Western Union. Not to be outdone, Western Union, after observing competitors and upstart services, has now stepped into the arena with the aforementioned pilot programs and even talk of potentially launching its own crypto wallet for consumers. These developments underscore that fintech and remittance companies see stablecoins as a way to out-innovate the traditional banking system and provide a superior customer experience in moving money globally.

Neobanks and digital-first banks are also joining the fray. Revolut, a UK-based fintech bank with global reach, has dabbled in crypto trading for its customers and reportedly has been exploring issuing a USD-pegged token (though details remain to be seen). In the U.S., some fintech-oriented banks (often chartered as special purpose institutions) like Silvergate and Signature were early supporters of stablecoin infrastructure before their demise, and new entrants are picking up the torch. Even social media and tech firms – recall Facebook’s ill-fated Libra project – have shown interest, which pressured regulators to come up with clearer rules. Now with those rules taking shape, it wouldn’t be surprising to see big tech or fintech try again to introduce stablecoin-based payment features in their platforms (imagine WhatsApp or Messenger allowing stablecoin remittances, for example).

Meanwhile, Circle, the issuer of USD Coin (USDC), and similar companies like Paxos (issuer of USDP, and the partner for PayPal’s PYUSD) are actively partnering with established players to extend stablecoin reach. Circle has launched a program called Circle Payments that targets banks and payment providers, aiming to make it easy for them to plug into USDC for things like international wires, treasury management, or merchant payments. They’re effectively offering stablecoin-as-a-service to the traditional sector. For instance, Circle worked with Visa on the aforementioned settlement pilot, and it’s courting fintechs and banks to use USDC as an alternative settlement medium in areas like trade finance or e-commerce payouts. Tether, the largest stablecoin issuer (though more prevalent in crypto trading and in Asia’s markets), has also reportedly engaged with certain payment processors in markets like the Middle East to use USDT for faster cross-border value transfers.

One notable development is that crypto-native companies are moving into spaces historically dominated by banks and payment firms. Exchanges like Coinbase are building out services for merchants (Coinbase Commerce), allowing businesses to accept stablecoins as payment. Some crypto firms are even seeking regulatory approval to operate more like banks – for example, applying for trust charters or banking licenses. In the U.S., the new stablecoin legislation (if fully enacted) could allow approved non-bank stablecoin issuers to access Federal Reserve payment infrastructure directly, blurring lines between traditional banks and fintechs. Circle has hinted at interest in a banking license; Coinbase has acquired licenses that let it offer custody and other financial services. These moves mean that the competitive landscape is shifting – banks and card networks are not only watching each other, but also a cadre of fintech upstarts and crypto firms all vying to shape the future of digital payments.

The takeaway here is that innovation in stablecoin payments is being driven heavily by fintech entrants. They are proving out the models and demonstrating the demand – whether it’s an SME saving 5% in fees by using a stablecoin to pay an overseas supplier, or a gig worker receiving wages instantly on a Saturday via a stablecoin transfer. As these successes accumulate, they put pressure on bigger institutions to follow suit or partner up. Indeed, many banks and card companies have chosen partnership over direct competition – for instance, Mastercard working with fintechs on crypto cards, Western Union possibly partnering with existing stablecoin networks rather than building one from scratch, or banks investing in crypto custody firms to offer those services to clients. This collaborative trend suggests a future where the distinction between “crypto company” and “financial institution” blurs, all converging on the goal of more efficient, inclusive payments.

Regulatory Clarity and Central Bank Perspectives

No discussion of stablecoins in 2025 is complete without addressing the regulatory developments and the stance of central banks. Regulation can make or break the adoption of a new financial technology, and over the past two years regulators have moved from simply studying stablecoins to actively writing rules for them. The emerging global regulatory consensus treats stablecoins as a legitimate part of the financial system – provided they are properly supervised and backed. This new clarity is, in fact, a major reason many banks and payment firms now feel more comfortable engaging with stablecoins.

In the United States, after high-profile debates, legislation is finally coming together. The U.S. Congress has been considering various stablecoin bills, and in mid-2025 a significant milestone was reached: the Senate passed the “Guiding and Establishing Nationwide Uniform Stablecoins Act”, nicknamed the GENIUS Act, and by July 2025 it was reported to be signed into law. This law creates the first federal framework for stablecoin issuers in the U.S. It requires any payment stablecoin (ones intended for general use, not just trading) to be fully backed by high-quality liquid assets (like cash or short-term Treasuries), mandates regular audits and disclosures of reserves, and crucially, it allows stablecoin issuers to seek federal approval and access to central bank services if they meet certain criteria (such as holding insurance like FDIC coverage for deposits). In essence, the U.S. is treating stablecoin issuers a bit like banks or money market funds, to ensure they are safe and interoperable with the broader financial infrastructure. For traditional financial institutions, this is welcome news: it means if they partner with or become a stablecoin issuer, there’s a clear rulebook to follow. The law also explicitly gives the Federal Reserve oversight over systemic stablecoins, addressing concerns about runs or instability. This clarity is already accelerating stablecoin projects – for example, right after the bill’s advancement, Western Union’s CEO cited the new legal certainty as one reason they green-lit their stablecoin pilot. Banks like JPMorgan and Citi also alluded to the legislation as key in their decision to ramp up stablecoin efforts (as noted on their earnings calls).

Across the Atlantic, the European Union has also acted. The EU’s comprehensive crypto-assets regulation, known as MiCA (Markets in Crypto-Assets), was passed in 2023 and is in the process of taking effect (phased in by 2024). MiCA includes a dedicated regime for “e-money tokens” and “asset-referenced tokens,” which effectively covers stablecoins. Issuers of euro or other fiat-pegged stablecoins in Europe will need to be licensed, maintain adequate reserves, and comply with consumer protection rules. Notably, MiCA puts caps on how large non-euro stablecoins can circulate in the EU without additional oversight, a nod to the European Central Bank’s concerns about eurozone monetary sovereignty. It also currently forbids stablecoin issuers from paying interest to token holders (to prevent unfair competition with bank deposits), which could slow adoption of stablecoin saving products in Europe. Nonetheless, MiCA provides the legal certainty that if a company like, say, Circle or a bank in France wants to issue a Euro-backed stablecoin for payments, they know the regulatory requirements upfront. We are already seeing European financial institutions test the waters: Société Générale’s digital asset arm launched a euro stablecoin for institutional clients, and several fintechs are developing euro and pound sterling stablecoins under the new rules.

The United Kingdom similarly has brought stablecoins into the perimeter by way of updates to its Financial Services and Markets Act, recognizing certain stablecoins as a form of regulated e-money that can be used in payments. Singapore, Japan, and Hong Kong – all major financial hubs – have rolled out or proposed their own stablecoin licensing frameworks. Japan’s rules (effective 2023) allow banks, trust companies, and licensed money transfer agents to issue stablecoins, and we’ve seen Japanese banks plan stablecoins for settlements (MUFG’s Progmat platform is one example enabling tokenized bank money, including potential yen and foreign currency stablecoins). Hong Kong’s Monetary Authority is crafting regulations to oversee stablecoin issuance by 2024, aiming to position Hong Kong as a regulated crypto finance center (with an eye on Asian dollar stablecoin flows). Singapore has issued guidelines on stablecoin reserve requirements and backed projects like Partior (a blockchain payment network co-founded by DBS Bank, JP Morgan, and Temasek) to facilitate cross-border digital currency transactions.

Central banks themselves have a dual role in this saga: as regulators of private stablecoins and as developers of Central Bank Digital Currencies (CBDCs), which can be seen as the public sector’s answer to stablecoins. Some central bankers view well-regulated stablecoins as complementary to future CBDCs or even as a bridge that can make monetary systems more efficient. Others remain wary, worrying that private currencies could undermine control of the money supply or facilitate illicit flows if not properly monitored. In practice, we see a bit of both attitudes. The U.S. Federal Reserve has been cautious on issuing a digital dollar (citing the need for Congressional approval and more study), but it has simultaneously worked to ensure any stablecoin operating in the U.S. is safe and under oversight (through the aforementioned legislation and through encouraging improvements in payment charters). The Fed’s officials have indicated that if stablecoins become widely used, they must not fragment the monetary system – hence the push for issuers to have access to Fed settlements, which would integrate stablecoins with traditional money rather than let them sit entirely outside.

In Europe, the ECB is moving forward on a prototype digital euro, but it acknowledges the role of private sector solutions too. In fact, the co-existence of CBDCs and stablecoins is likely; they serve somewhat different markets (retail CBDC for general public use vs. stablecoins for specialized payments and digital ecosystem use). Some central bankers have explicitly said that if banks and regulated entities issue their own stablecoins (essentially tokenized deposits), it might achieve many of the same benefits as a CBDC without the central bank needing to manage millions of retail accounts. This view is partly why projects like Canton Network or multiple bank deposit token initiatives are watched closely by central banks.

Importantly, central banks and public authorities are also experimenting with stablecoin technology for interbank use. A prime example is Project mBridge, a collaboration between the central banks of China, Hong Kong, Thailand, and the UAE (under the Bank for International Settlements) to use a common platform for settling cross-border payments with tokenized central bank money. While mBridge uses CBDC units, its goals mirror those of stablecoins – faster, cheaper cross-border settlement. Similarly, the BIS and Swiss National Bank’s Project Helvetia looked at using tokenized central bank money to settle tokenized assets on a exchange. These experiments acknowledge that the concept introduced by stablecoins – instant digital cash transfers – is powerful for upgrading financial market plumbing.

In summary, the regulatory landscape in 2025 is increasingly favorable for stablecoins if they comply with new rules. The era of operating in a gray zone is ending. Paradoxically, this tends to legitimize stablecoins in the eyes of big institutions. Banks and payment companies are fundamentally conservative when it comes to compliance; now that major jurisdictions are saying “here’s a lawful path to use this technology,” it unlocks a lot of corporate activity. It’s telling that many initiatives (Western Union’s pilots, PayPal’s launch, banks mulling their own tokens) gained momentum only after regulators signaled support or at least tolerance under defined conditions.

From a competitive standpoint, regulation also means an even playing field is being established. A fintech startup issuing a stablecoin or a big bank issuing one will have to play by similar liquidity and disclosure rules – theoretically preventing a “race to the bottom” on risk and giving public confidence in stablecoins comparable to bank deposits. This benefits the incumbents because trust is their currency; a well-regulated environment plays to their strengths (risk management, compliance expertise, and existing licenses). Meanwhile, central banks will keep a close eye and are likely to integrate stablecoins into the broader monetary system (for example, by allowing conversions at par with central bank reserves, or even one day settling stablecoin transactions through Fed or ECB infrastructure). All of these developments reinforce the idea that stablecoins, rather than existing in a Wild West separate from traditional finance, are being woven into the fabric of mainstream finance with the blessing of regulators – which in turn encourages banks and networks to adopt them, not shun them.

New Business Models and Competitive Dynamics

The advent of stablecoin payments is not only changing operational processes but also giving rise to new business models and reshaping competitive dynamics in finance. For forward-thinking banks and payment firms, stablecoins offer more than just a faster way to move money – they open up avenues to generate revenue and serve customers in novel ways. At the same time, they shift the competitive landscape by lowering barriers to entry in some payment markets, forcing incumbents to innovate.

One immediate opportunity is in cost savings and efficiency gains. By using stablecoins for settlement (whether in interbank transfers, card network settlements, or remittances), institutions can save on the fees and capital costs associated with traditional payments. For example, when Visa uses USDC to settle with an acquirer in another country, it potentially avoids using correspondent banking channels that might tie up liquidity or incur FX spreads. Over time, if such practices scale, banks and payment companies could streamline their treasury operations, reduce their need to pre-fund accounts around the world, and even minimize currency conversion costs by using stablecoins as a universal settlement medium. These efficiencies can translate into bottom-line savings or allow firms to offer more competitive pricing to customers. A bank that can send money for fractions of a cent via stablecoin rails might cut its fees for customers (or improve its margins if fees stay the same). Lower costs also create the possibility of microtransactions and new markets – transactions that were uneconomical before (like sending a few cents or enabling pay-per-use digital services) become viable, potentially expanding the overall pie of payment volume.

There is also a treasury management angle. Some corporations and even fintechs holding large balances are attracted to the idea of keeping funds in a tokenized form that’s easily deployable globally. We see the rise of “yield-bearing stablecoins” or tokenized deposits that can earn a return while parked. For instance, a few asset managers have launched tokens representing shares in money market funds (holding T-bills) that can be used for payments while also earning interest. This blurs the line between payment and investment. If a business can hold $10 million in a digital fund token that earns, say, 4% annual yield, and still use that token to pay suppliers in real time, that’s very attractive compared to leaving $10 million idle in a checking account earning near-zero. Banks are taking note of this and could either create competing products (like offering tokenized versions of deposits or money market instruments to clients) or integrate these into their platforms. In the U.S., Coinbase already offers a 4% reward on USDC holdings to retail users, effectively sharing some of the yield from the Treasury bills backing USDC. Traditional banks generally can’t pay interest on checking at that level, so this is a new competitive pressure. However, in Europe, as mentioned, regulators have restricted stablecoin issuers from passing on interest – which ironically might give banks an edge (since banks can legally pay interest on deposits, they could argue a bank-issued stablecoin is safer and maybe even interest-bearing in some contexts, whereas a non-bank stablecoin in the EU cannot entice users with yield).

Programmability is another game-changer. Stablecoins run on smart contract platforms, which means payments can be coupled with self-executing code. This allows for innovative use cases: imagine programmable money that releases to a supplier only when goods are delivered (automating escrow), or insurance payouts that trigger instantly when an event is verified, or payroll that streams by the second rather than bi-weekly. These capabilities can underpin new services from fintechs and banks. For example, banks might offer “smart escrow” services for trade finance using stablecoins, reducing the need for letters of credit. Mastercard has pointed to the idea of using stablecoins in B2B supply chain payments, where conditions and data can travel with the payment. In Singapore, the concept of “Purpose-Bound Money” has been trialed – essentially tokens that can only be spent for specific purposes (like relief funds usable only for food). A private-sector stablecoin that supports such features could be part of government or NGO disbursement programs, which is a new line of business for payments companies (facilitating programmable aid or subsidy distribution).

On the competitive front, stablecoins are reducing barriers to entry in certain areas of finance, which is spurring incumbents to adapt quickly. Historically, moving money internationally or processing payments at scale required joining exclusive networks (like SWIFT or card networks) or maintaining banking relationships in each country. With stablecoins and public blockchain networks, a small fintech startup can theoretically facilitate cross-border transfers by interfacing with just the blockchain and local on/off ramps, without owning a banking network. This means banks and money transfer operators no longer compete only among themselves; they must also contend with nimble crypto startups that can scale quickly via blockchain. We have already seen peer-to-peer payment apps that use stablecoins (like some built on Stellar or other networks) allowing users to send money globally with just a phone app – something that would have required a whole correspondent banking setup in the past.

This dynamic is pushing traditional players towards collaboration and consortia. For example, we might see groups of banks band together to create industry-standard stablecoins or shared platforms (to prevent each bank from being disrupted individually). The earlier reference to a “Zelle for stablecoins” hints at that – banks trust a network they collectively own. Similarly, the card networks are inviting fintechs in rather than excluding them; Visa’s fintech fast-track programs and Mastercard’s crypto card partnerships are ways to bring new entrants onto their side rather than letting a parallel ecosystem render them obsolete.

For consumers and end-users, these competitive shifts should be beneficial: more choices, potentially lower fees, and innovative services. We may soon have the option to pay a merchant either via a card (with our bank converting stablecoins in the background) or directly with a stablecoin from our digital wallet, whichever is more convenient or offers better rewards. In fact, stablecoins might enable new rewards and loyalty models – consider a scenario where a merchant prefers receiving stablecoins (to avoid card fees) and thus offers a discount if you pay in stablecoin. That could prompt payment companies to create incentives or one-click solutions to pay in stablecoin but through their interface (ensuring they still capture some value from the transaction). Visa and Mastercard might earn fees not from interchange in such cases but from providing guarantee and identity services on those transactions.

It’s also possible we’ll see merger and acquisition activity as a result of this stablecoin trend. Big financial institutions might acquire crypto firms for their technology or user base. Likewise, crypto firms might seek to acquire companies with licenses (we saw a hint of this with custodial banks and crypto firms mutual investments). The line “buy or build” mentioned by Mastercard’s CFO about entering the stablecoin space underscores that large firms are contemplating all options to stay competitive.

Overall, the business model evolution can be summarized as moving from a purely fee-for-service model toward a more platform-based model. Payment providers are looking at how they can embed themselves in the tokenized economy as platform operators, connectors, and liquidity providers, rather than just charging per transaction fees. This may involve new revenue streams such as consulting on stablecoin integration (which Visa’s consulting arm is doing), earning interest on float (like stablecoin issuers do, or sharing it with customers), providing compliance-as-a-service for blockchain transactions, or even data monetization from more transparent payment flows.

Crucially, for banks and card networks, embracing these new models turns the stablecoin question from a threat into an opportunity. It allows them to expand their role: from simply processing payments to also facilitating digital asset storage, exchange, and value-add services around those assets. Many are already well on their way – banks creating digital asset custody divisions, and card networks running blockchain validator nodes and investing in crypto startups. The competitive moat of the future may be not just who has the most ATMs or merchant relationships, but who has the strongest API integrations into various blockchains and the best partnerships with fintech ecosystems.

Conclusion: Adaptation Turns Threat into Opportunity

The rapid rise of stablecoin payments has undeniably introduced a disruptive element to the financial services status quo. For banks and card networks that have for decades enjoyed a central role in the movement of money, stablecoins at first seemed to pose an existential question: Will we be disintermediated by new digital currency systems, or can we harness them to our advantage? After extensive analysis and early experience, the answer that’s emerging is hopeful – with adaptation and proactive strategy, stablecoins can be more of a lifeline than a threat.

What we are witnessing in 2025 is the beginning of a synthesis between the old and the new. Banks are collaborating with blockchain innovators; card networks are embedding stablecoin capabilities into their offerings. Rather than being bypassed, these incumbents are striving to become the preferred on-ramps, off-ramps, and platforms for stablecoin usage. In doing so, they stand to modernize their infrastructure (achieving speeds and efficiencies previously thought unattainable), extend their services to new customer segments (such as the unbanked or crypto-savvy clients), and create fresh revenue streams (from consulting, custody, to transaction fees in crypto ecosystems).

None of this is to say the transition is without challenges. Issues around cybersecurity, compliance (like ensuring anti-money-laundering controls on pseudonymous stablecoin transactions), and technological integration are non-trivial. Financial institutions will need robust risk management for dealing with digital assets, and regulators will be scrutinizing implementations closely. There’s also the matter of market trust – stablecoins rely on confidence in their backing, so any misstep (like a failure to redeem 1-for-1, or a major hack on a wallet provider) could cause setbacks. Incumbents entering this space carry their reputation with them, which is a double-edged sword: it can reassure users that a bank-issued or network-supported stablecoin is safe, but it also means those institutions must uphold high standards in a fast-evolving field.

Yet, despite these growing pains, the direction of travel is clear. The genie of instant, borderless digital money is out of the bottle, and it aligns with the broader digitalization of commerce and society. Banks and payment companies that lean into this trend are likely to find themselves at the vanguard of the next financial era. They’ll be the ones enabling a small business in Nairobi to instantly receive a payment from a client in New York on a Sunday, or a bank in London to settle a trade with a bank in Singapore within seconds, or a consumer in Toronto to seamlessly switch between using a CBDC, a stablecoin, or a traditional bank card based on convenience. Those capabilities would have sounded far-fetched a decade ago; today they are on the strategic roadmaps of forward-looking financial firms.

From a competitive standpoint, embracing stablecoins is increasingly seen as a defensive and offensive play. Defensively, it ensures that new fintech disruptors cannot offer fundamentally superior services that leave traditional players obsolete – because the traditional players themselves will offer similar speed and cost-efficiency, just wrapped in the trust and familiarity of their brands. Offensively, it opens pathways into new markets (like providing the infrastructure for the burgeoning digital asset economy, or becoming the settlement network of choice for various tokenized value exchange). In time, we may drop the qualifier “stablecoin” and simply talk about digital dollars or euros, with the understanding that they’re often moving on blockchain rails. When that day comes, today’s banks and payment companies intend to still be indispensable, just as they are in physical and electronic money today.

In conclusion, stablecoin payments are proving to be less a zero-sum threat and more a catalyst for evolution in the financial industry. The institutions that recognize this – as many leading banks and networks now do – are taking steps to ensure stablecoins become a lifeline that rejuvenates their services. By cutting costs, reaching the underserved, and spurring innovation, stablecoins can help legacy players solve problems that have long plagued global finance (such as expensive remittances and slow settlements) and thereby secure their relevance in the decades ahead. The message is clear: stablecoins and traditional finance are converging, and in that convergence lies an opportunity to build a more efficient, inclusive, and dynamic payment ecosystem. The winners will be those who adapt, collaborate, and leverage the best of both worlds.

References

- Payments Dive – “Mastercard, Visa play down stablecoin threat” (Lynne Marek, July 17, 2025). [Link]

- Payments Dive – “Mastercard, PayPal mull stablecoins for B2B payments” (Lynne Marek, April 2, 2025). [Link]

- McKinsey & Co. – “The stable door opens: How tokenized cash enables next-gen payments” (Matt Higginson & Garry Spanz, July 21, 2025). [Link]

- CryptoSlate – “Stablecoins infiltrate deeper into global finance as Western Union enters crypto” (Liam Wright, July 22, 2025). [Link]

- Ledger Insights – “Citi, JP Morgan confirm leaning into stablecoins, tokenized deposits” (July 16, 2025). [Link]

- Crypto Economy – “PayPal CEO Sees Cross-Border Payments as Key Use Case for Stablecoins” (June 27, 2025). [Link]

- Visa Press Release – “Visa Expands Stablecoin Settlement Capabilities to Merchant Acquirers” (Sept 5, 2023). [Link]

- Bloomberg – “JPMorgan says JPM Coin now handles $1 billion transactions daily” (October 26, 2023). [Link]

- Reuters – “Mastercard links up with Stablecoin Paxos for crypto card payments” (June 2023). [Link]